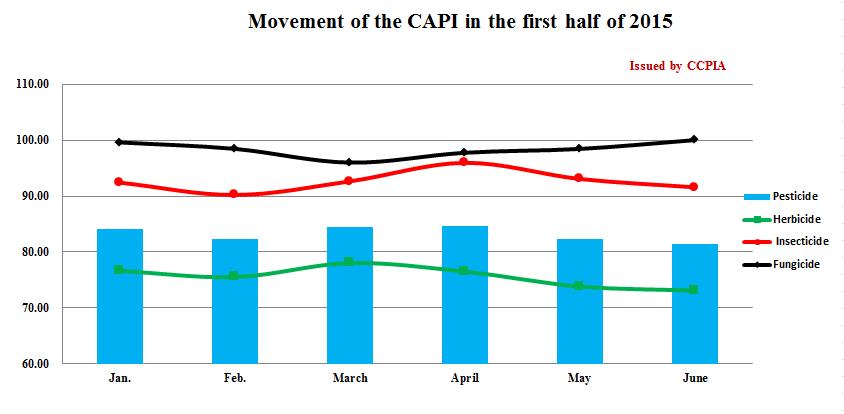

In the Chinese agrochemical industry in the first half of the year, despite constantly emerging favorable factors, the industry maintained at a low level on the whole due to lack of international demand. According to the statistics of China Crop Protection Industry Association (CCPIA), the overall CAPI of pesticides maintained between 81.0 and 85.0, a significant fall from last year, with the greatest fall being up to 20.05%; seen from the statistical enterprises, the number of discontinued enterprises in May and June increased significantly compared to that in the previous four months, which was directly reflected in the decrease in monthly production; in June, the CAPI dropped to 81.39, the lowest in the first half of the year, down 1.22% month on month and down 18.20% year on year.

The movement of the CAPI in the first half of the year is as shown in Figure 1 below. From the figure we can see that the CAPI of herbicides fluctuated between 73.0-79.0, maintaining at the lowest level among other pesticide varieties and reaching the lowest level in June at 73.10, a month-on-month fall of 1.00% and a year-on-year fall of 26.50%. Except glyphosate, the transaction prices of the technical of many herbicides such as 2,4-D, paraquat, acetochlor and atrazine fell. In the high temperature period and slack season, the business of the herbicide market is slack, the demand is weak and the prices are on an obvious falling trend. The herbicide market is expected to maintain at a low level for some time in future. Figure 1 Movement of the CAPI in the first half of 2015

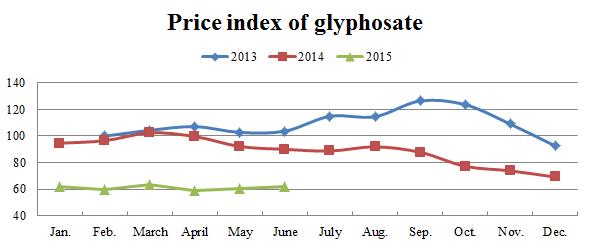

The transaction prices of the technical of pesticides in the first half of the year fluctuated within a relatively low price range, of which that of the herbicide glyphosate saw the biggest fluctuations. Due to the price hikes earlier in the market and the less-than-expected supply and demand, glyphosate was “depressed” after sharp rises and falls. Many manufacturers already manufacture at a price close to cost price and even lower. The average weighted transaction price of glyphosate in the first half of the year was RMB19,600 per ton, down 51.72% from the highest price (RMB40,600 per ton) in 2013 and down 36.36%from the average price in the first half of last year, which had pulled down the price index of herbicides to a great extent. Figure 2 Price index of glyphosate

Form Figure 1 we can see that the CAPI of insecticides in the first half of the year maintained stable on the whole. Rising first and then falling, the price index fluctuated between 90.0 and 96.0 and reached the highest in April at 95.98. Among the insecticides, dipterex, chlorpyrifos and malathion saw a relatively significant change in their transaction prices. In June, the CAPI of insecticides was 91.59, down 1.60% month on month and down 6.19% year on year.

Compared to herbicides and insecticides, Fungicides were the most stable, no matter in market scale or price. In the first half of the year, the CAPI of Fungicides maintained stable, fluctuating slightly between 96.0 and 100.5. It fell in March and April but picked up later, as shown in Figure 1. In June, the CAPI of bactericides continued to go up and reached 100.04, up 1.61% month on month but down 1.25% year on year.

|

Category |

CAPI in June |

Month-on-month (%) |

Year-on-year (%) |

|

Pesticide |

81.39 |

↓1.22 |

↓18.20 |

|

Herbicide |

73.10 |

↓1.00 |

↓26.50 |

|

Insecticide |

91.59 |

↓1.60 |

↓6.19 |

|

100.40 |

↓1.61 |

↓1.25 |